Farming can be a risky endeavor. While farmers in developed countries have access to a range of financial instruments—including credit and insurance—to manage agricultural risks, many farmers in developing countries cannot fall back on such a safety net. For these farmers, risk is one of the main barriers to expanding investments in agriculture.

IFPRI research in this theme aims to improve the availability, affordability, and quality of crop insurance and other financial instruments to reduce the risk of agricultural investments. This includes improving product design through technology and institutional innovations, and rigorous impact evaluations to study the cost-effectiveness of these innovations in enhancing resilience.

IFPRI researchers are developing innovative products attuned to the local needs of both farmers and bankers and insurers, such as picture-based crop insurance (PBI) and risk-contingent credit. IFPRI’s research on risk and insurance is closely aligned with the Sustainable Development Goals (SDGs), including SDG 1, SDG 2, and SDG 10.

Basis risk, social comparison, perceptions of fairness and demand for insurance: A field experiment in Ethiopia

Challenges and opportunities in implementing video-based extension approaches targeting women farmers: An implementer’s perspective

Bundling cash loans with agricultural input loans for farmers in Nigeria: A pilot study

Myanmar Agricultural Performance Survey (MAPS) dry season 2023: Agricultural input markets, credit and extension services

Feasibility of implementing a Risk-Contingent Credit (RCC) program in Zambia: Stakeholder engagement

Climate insurance: Opportunities for improving agricultural risk managment in Kenya

Ethiopia’s Land Rental Market Partners Survey, 2019

Agricultural Extension Services and Technology Adoption Survey, 2016

Agricultural Extension Services and Technology Adoption Survey, 2018

Crop Monitoring Using Smartphone Based Near-Surface Remote Sensing: Ground Pictures of Wheat and Auxiliary Data from Northern India

Picture Based Insurance (PBI) in India, 2016-17

Ethiopia Africa Research in Sustainable Intensification for the Next Generation (Africa RISING) Baseline Evaluation Survey

IFPRI Program/Country EventOct, 26 2021

IFPRI Program/Country EventOct, 26 2021Innovations in agricultural insurance: Lessons learnt about managing smallholder farmer risks

IFPRI at External EventOct, 10 - 11 2019

IFPRI at External EventOct, 10 - 11 2019Challenges and Opportunities for Latin American Agriculture

IFPRI at External EventOct, 8 - 10 2019 (Oct, 7 - 10 2019)

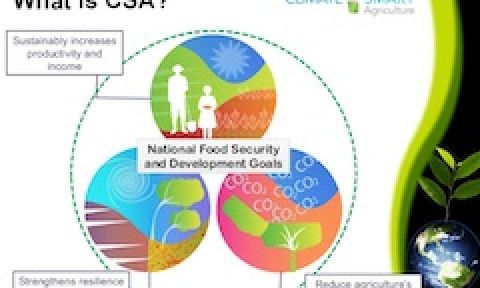

IFPRI at External EventOct, 8 - 10 2019 (Oct, 7 - 10 2019)The 5th Global Science Conference on Climate-Smart Agriculture 2019

IFPRI Policy SeminarMay, 9 2019

IFPRI Policy SeminarMay, 9 2019Building Resilience through Financial Inclusion: A Review of Existing Evidence and Knowledge Gaps

IFPRI Program/Country EventFeb, 7 2019

IFPRI Program/Country EventFeb, 7 2019The Knowledge Lab on Climate Resilient Food Systems: An analytical support facility to achieve the SDGs

Series/Special EventMay, 29 - 30 2018

Series/Special EventMay, 29 - 30 2018Financial Inclusion and Climate Resilience Roundtable

- In the News

Kenyan Farmers Benefit From Insured Loans (VOA)

- In the News

Making crop insurance work for Indian farmers

Joseph Glauber

Senior Research Fellow

Liangzhi You

Senior Research Fellow

Berber Kramer

Senior Research Fellow

Francisco Ceballos

Research Fellow