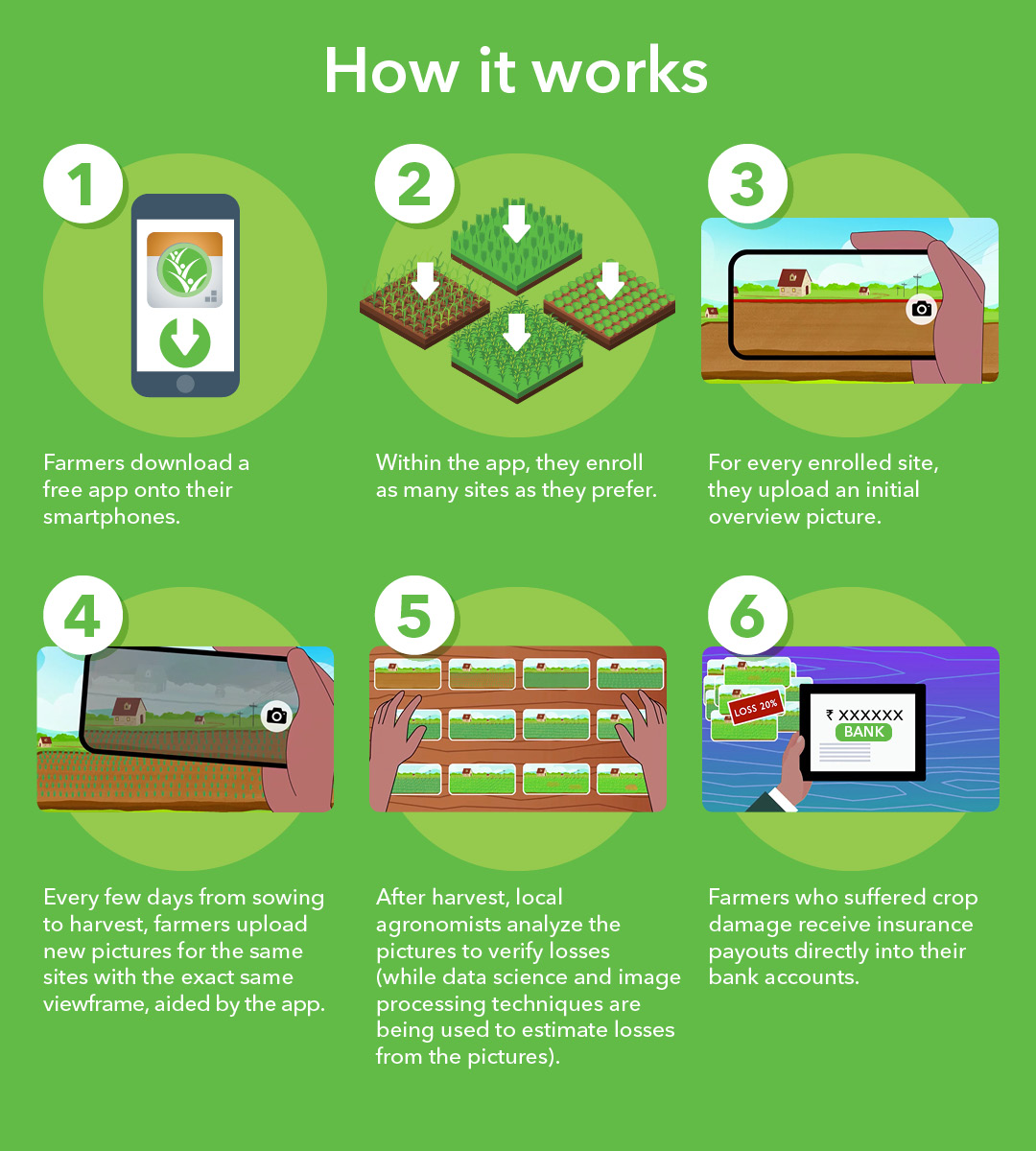

Picture-Based Insurance is a new, innovative way of delivering affordable, comprehensive, and easy-to-understand crop insurance. By relying on visible crop characteristics derived from farmers’ own smartphone pictures, the project aims to minimize the costs of loss verification and detect damage at the plot level, making crop insurance more attractive and accessible to small farmers. Importantly, such an instrument lends itself to natural synergies with agro-advisories, adoption of climate-smart practices, and other value added services.

Where we work

IFPRI and its partners are testing this approach in different locations in Ethiopia, Kenya and India. While initially, the research was focused on providing a proof of concept for the technology, our current focus is on analyzing how improved crop monitoring affects insurance markets and whether the technology has applications beyond insurance.

In addition, the research program analyzes the impacts of services facilitated by this technology, such as insurance, seeds or credit, on smallholder farmers’ productivity, welfare and resilience, while paying attention to mechanisms through which the technology can reduce—rather than aggravate—inequity and gender gaps.