On February 2, 2026, the United States and India finalized a trade deal in which the U.S. will reduce its tariffs from 50% to 18% on merchandise imports from India. Earlier, on August 1, 2025, U.S. imposed 25% tariff on such imports (comprising a 10% baseline tariff + 15% reciprocal component). These tariffs cover around 70% of India’s exports to the U.S. Further, on August 27, 2025, an additional 25% tariff was implemented, as a penalty for Russian oil purchases, bringing the tariff rate to 50%. The measure was among the highest U.S. tariffs on any country, raising significant concerns for the Indian economy, as the U.S. has been a major trading partner.

Total India-U.S. merchandise trade has grown rapidly in the past decade, rising from $53 billion in 2014 to $79 billion in 2022. In 2022, India’s exports to the U.S. accounted for more than 60% of total bilateral trade. The U.S. emerged as India’s top trading partner in 2022, contributing about 11% of India’s overall trade, while India accounted for around 2.5% of total U.S. trade. The U.S. also accounted for around one-fifth of India’s total exports in 2022. These trade values are deflated using the GDP deflator of India obtained from the Ministry of Statistics and Programme Implementation.

The difference in tariff structures between the two nations provides some context for the recent U.S. policy shift favoring higher tariffs. In 2022, for instance, India imposed tariffs of around 32% on agricultural products, 10% on mining products, and 30% on manufacturing products from the U.S. In contrast, U.S. tariffs on imports from India on these products were only 3.2%, 0.5%, and 5.0%, respectively. India, like many developing countries, maintains higher tariffs to protect fragile industries and to support limited government revenue, which remains consistent with World Trade Organization (WTO) rules. On the other hand, the additional U.S. tariffs on India aim to address trade imbalances, support domestic manufacturing, and respond to broader geopolitical concerns.

Although India managed a new trade deal with the U.S., recent experience suggests the trade relationship may remain strained. India should thus explore alternative markets and trade opportunities; despite the geopolitical uncertainties this brings. In September 2025, following months of review, the Indian government revised its Goods and Services Tax (GST) system—an indirect tax levied on the supply of goods and services in India, with the final burden borne by the end consumer. The reform reduced the basic goods tax rate from 28% to 5% and even 0% for some commodities. For example, GST on machinery, equipment, and vehicles, have been reduced from 28% to 18%. For some life-saving medicines, life insurance, staple food, and dairy products, rates have been reduced to 0%. Whereas in the case of tobacco and beverages, the rate has increased from 28% to 40%. Experts believe these reforms are likely to boost domestic demand, investment, and employment. Therefore, the question arises: can these GST reforms cushion India’s economy against the impacts of U.S. tariffs?

In this post, we present a rapid assessment using an economywide model to examine the impact of GST reforms on the Indian economy in the presence of U.S. tariffs on Indian exports—finding these changes will indeed cushion some of the economic blow from the tariffs. We employ IFPRI’s dynamic computable general equilibrium (CGE) model to estimate the impact on key macroeconomic indicators such as GDP, exports, imports, and the government budget deficit, as well as welfare indicators such as employment and household income. Specifically, the following scenarios are explored:

- Scenario 1: GST reforms only—changes in GST rates and no U.S. tariff increments.

- Scenario 2: U.S. incremental tariffs of 50%, no GST reforms.

- Scenario 3: U.S. incremental tariffs of 50% along with GST reforms.

- Scenario 4: U.S. reduces incremental tariffs to 18% under a new trade deal, combined with GST reforms.

Economic impact pathway of U.S. tariff and GST reforms

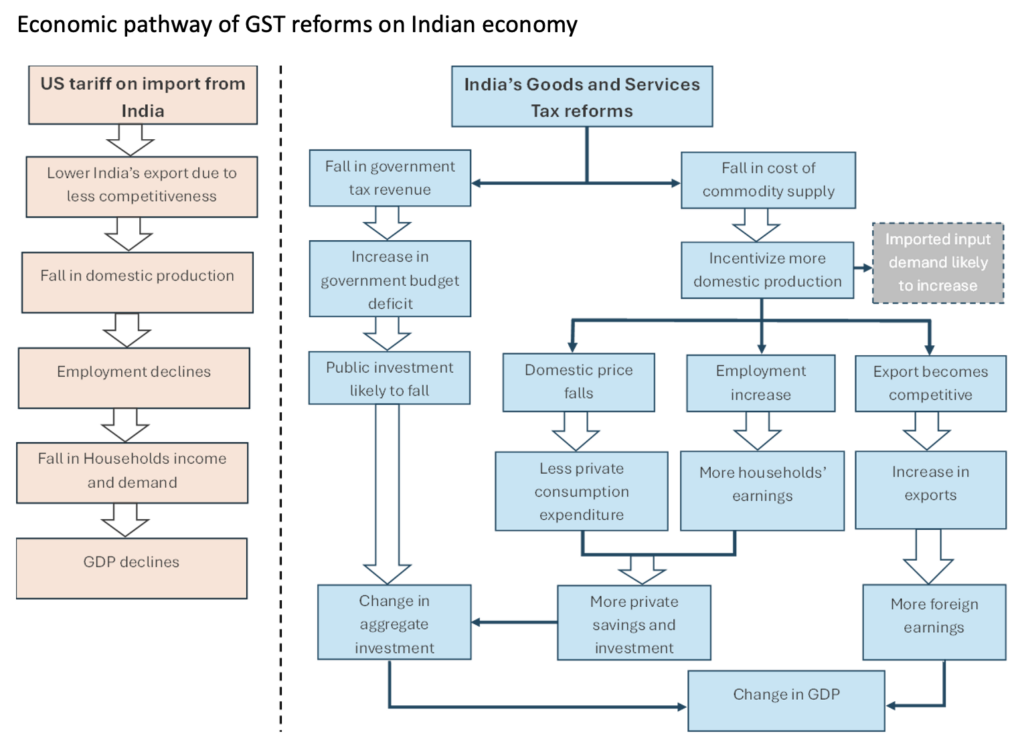

Figure 1 illustrates the contrasting economic pathways through which U.S. tariffs and India’s GST reforms affect the Indian economy. The left panel shows that higher U.S. tariffs reduce India’s export competitiveness, leading to lower export earnings, a fall in domestic production and employment, and a subsequent decline in household income, demand, and GDP.

By contrast, the right panel shows that GST reforms have the opposite, expansionary effect. Lower GST rates reduce the cost of production, making Indian goods more competitive and stimulating domestic output and exports. Higher employment and household earnings further raise private savings and investment, partially offsetting the decline in government revenue and public investment.

Overall, the effects of GST reforms and U.S. tariffs move in opposite directions across key macroeconomic indicators—exports, employment, investment, and GDP—highlighting how domestic tax reform can partly cushion the adverse impact of external trade shocks.

Figure 1

Results

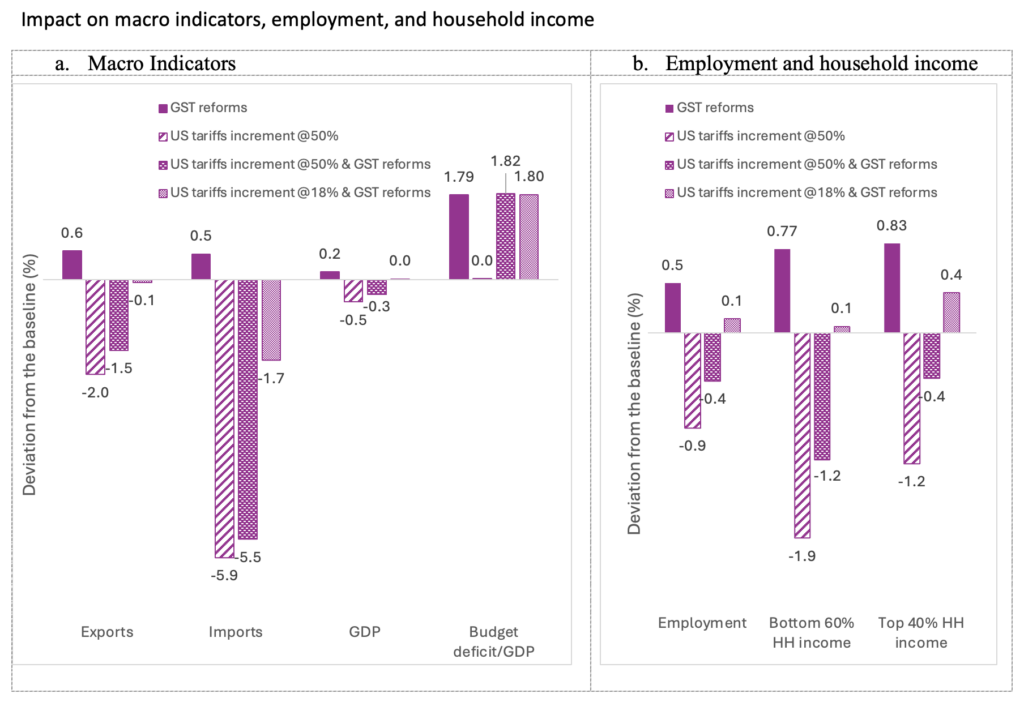

Under scenario 1, GST reforms alone result in a 0.2% increase in GDP (Figure 2a), a 0.5% increase in employment (Figure 2b), and a rise in total exports of 0.6%, slightly higher than total imports, which increase by 0.5% (Figure 2a). Indian households are classified into two groups based on expenditure quintile: the bottom 60% and the top 40%. The bottom 60% are the approximately 800 million beneficiaries out of India’s total 1.4 billion population who receive free food grain under the government’s National Food Security Act. GST reforms benefit both groups: income for the bottom 60% increases by 0.77% and for the top 40% by 0.83% over the baseline (Figure 2b). However, the budget deficit-to-GDP share increases by 1.79% over the baseline due to a fall in tax revenue, potentially leading to lower government spending.

Figure 2

Figure 2 also shows that without GST reforms, India’s GDP falls by 0.5% under the 50% U.S. incremental tariffs scenario (scenario 2). With GST reforms alongside incremental tariffs (scenario 3), however, GDP falls only by 0.3%. This implies that GST reforms save 0.2 percentage points of GDP growth. Our results are consistent with findings reported by both the International Monetary Fund and the Reserve Bank of India.

Similarly, in scenario 2, export revenue falls by 2%, while in scenario 3, it falls by 1.5%, implying a 0.5 percentage point improvement. Comparing scenarios 2 and 3, GST reforms amid additional U.S. tariffs provide partial relief in unemployment and household income losses (Figure 2b).

Finally, the new trade deal reduces the incremental tariffs to 18% while the GST reforms are in place (scenario 4), exports and imports fall by 0.1% and 1.7%, respectively. Under this scenario, general equilibrium effects yield marginal improvements in GDP, employment, and household incomes.

GST reforms and the imposition of tariffs lead to resource reallocation among different sectors, affecting them in varying ways, depending on linkages across them. Simulated results show that under the U.S. tariffs scenario (scenario 2 [Table 1]), services such as finance and hospitality perform relatively better, supported by the depreciation of the Indian rupee. However, export-oriented sectors like textiles and clothing experience notable output declines due to weaker foreign demand and higher input costs. GST reforms, by lowering production costs, provide relief to manufacturing sectors—particularly metals and machinery, and chemicals, helping to offset some tariff-induced losses.

Tabie 1

Policy insights

The analysis shows that GST reforms alone have a positive effect on the Indian economy such as increases in employment, trade (both import and export), GDP, and household incomes. Moreover, the reforms partially offset the economic losses that would have occurred due to 50% U.S. tariff. Although the new trade deal reduces the U.S. tariff to 18%, the net effect on India’s GDP remains lower than that observed under the GST-only scenario. Thus, the analysis offers important insights on recent GST reforms and their potential macroeconomic implications for the Indian economy post the U.S. trade policy shift:

- Balancing fiscal and growth objectives. Lower GST rates stimulate production and employment, raise incomes for poorer households and support private savings. However, they also increase the government budget deficit, which further reduces capital expenditure of the government. Since public capital expenditure enables environment for private investment, an increase in the budget deficit might have adverse effect on the aggregate (private plus public) investment.

- Mobilizing private savings for investment. Since lower GST reduces government revenue and increases the deficit, the government could channel higher private savings into development projects to sustain growth and offset the decline in public investment.

- Need for trade diversification. Going forward, to fully reap the potential gains from GST reforms and mitigate adverse shocks arising from external trade policy volatility, India shoulddiversify its export markets and strengthen partnerships with existing and new trading partners, enabling its economy to adjust and build resilience to such shocks.

Barun Deb Pal is a Research Coordinator with IFPRI’s Foresight and Policy Modeling (FPM) Unit; Manmeet Ajmani is an FPM Senior Research Analyst. They are based in New Delhi. This post is based on research that is not yet peer-reviewed. Opinions are the authors’.

This work was supported by the CGIAR Science Program on Policy Innovations.