The economic cost of natural disasters is usually expressed in physical terms: Destruction of assets, crop losses, costs of reconstruction and the like. Yet, experiencing a disaster also affects people psychologically and emotionally, leading them to think differently, act differently, and alter the way they make decisions—including economic decisions. In that sense, the psychological impacts of a disaster may continue to have profound economic impacts long after reconstruction is finished. A team of American and Chinese economists went in search of those psychological impacts and tried to find out how a disaster affects people as economic actors. What they found is at odds with standard economic thinking.

Because natural disasters bring destruction and hardship, people living in disaster-prone areas need to safeguard against them. It makes intuitive sense: The notion of “saving for a rainy day” is deeply ingrained in our collective thinking. Economists have extensively documented how people accumulate savings in anticipation of hard times and later use those savings to get through the rough patches, a process they refer to as “consumption smoothing” (Rosenzweig and Stark, 1989; Udry, 1995). Most economic theories would thus predict that those who have experienced a disaster would start safeguarding against the next one, by increasing their savings, for instance. But in this case, the team found the opposite.

The study focused on China’s Sichuan province, which was hit by a severe earthquake in 2008. While talking to villagers after the quake, the team noticed that rather than worrying about earthquake preparedness, many of them talked about wanting to “enjoy life while it lasts.” They reported spending more time with their friends playing mahjong (the Chinese 4-player game). The team wondered whether this attitude extended to other economic behaviors such as spending and saving, and whether they would be able to measure these effects with economic data. By happenstance, some of the hardest hit areas had been surveyed in 2007; thus, there was a pre-earthquake baseline of data. The researchers conducted follow-up surveys in 2009 and 2011, which enabled them to make before/after comparisons.

To isolate the psychological impacts of the earthquake, the team focused on household members in areas struck by the earthquake, but whose homes were not damaged, who suffered no injuries, and who were otherwise unaffected by the quake. In other words, households that incurred no immediate economic losses in the quake but may still have been affected psychologically by the experience. Once we account for changes in external factors such as prices or job prospects, any changes to the observed behavior of such households would thus be driven by “psychological” factors.

The researchers looked at three behaviors: Saving, drinking, and playing mahjong. They found that, on average, people who were spared by the earthquake but lived closer to the epicenter tended to decrease their saving, increase their drinking, and play mahjong more often. This was not due to changes in their income, which was not affected by proximity to the quake. Figure 1 shows that while a change in income was not affected by distance to epicenter, expenditures increased more for households that were closer to it. Results also held true after the researchers took into account potential confounders such as gifts given to affected households out of solidarity, price levels, or government aid.

Source: Filipski et al. (2019)

All three of these behaviors seem to reflect an Epicurean attitude toward life. Households closer to the epicenter seem to have become more willing to take risks, both with their money (saving less) and their health (drinking more). As for mahjong, it serves as a fun pastime but also doubles as a risk-taking activity, as players usually put up small money stakes to spice up the game. All behaviors suggest that rather than safeguarding against the next earthquake, people who lived through the tremors became more inclined, as the saying goes, to “live like there’s no tomorrow.”

The consequences of such a shift in attitudes are not straightforward to evaluate. The additional spending might give a slight boost to the local economy, but the drinking and gambling might not. It also remains unclear what happens in the longer term. The authors are able to show that the effects persisted until 2011, three years after the quake and long after reconstruction was finished—but after that, there is no data. It is possible that people who formed habits of spending, drinking, and playing mahjong after the quake kept them in the long run, but it is equally possible that the fear of another earthquake kicked in after some time and lead people back to more frugal ways.

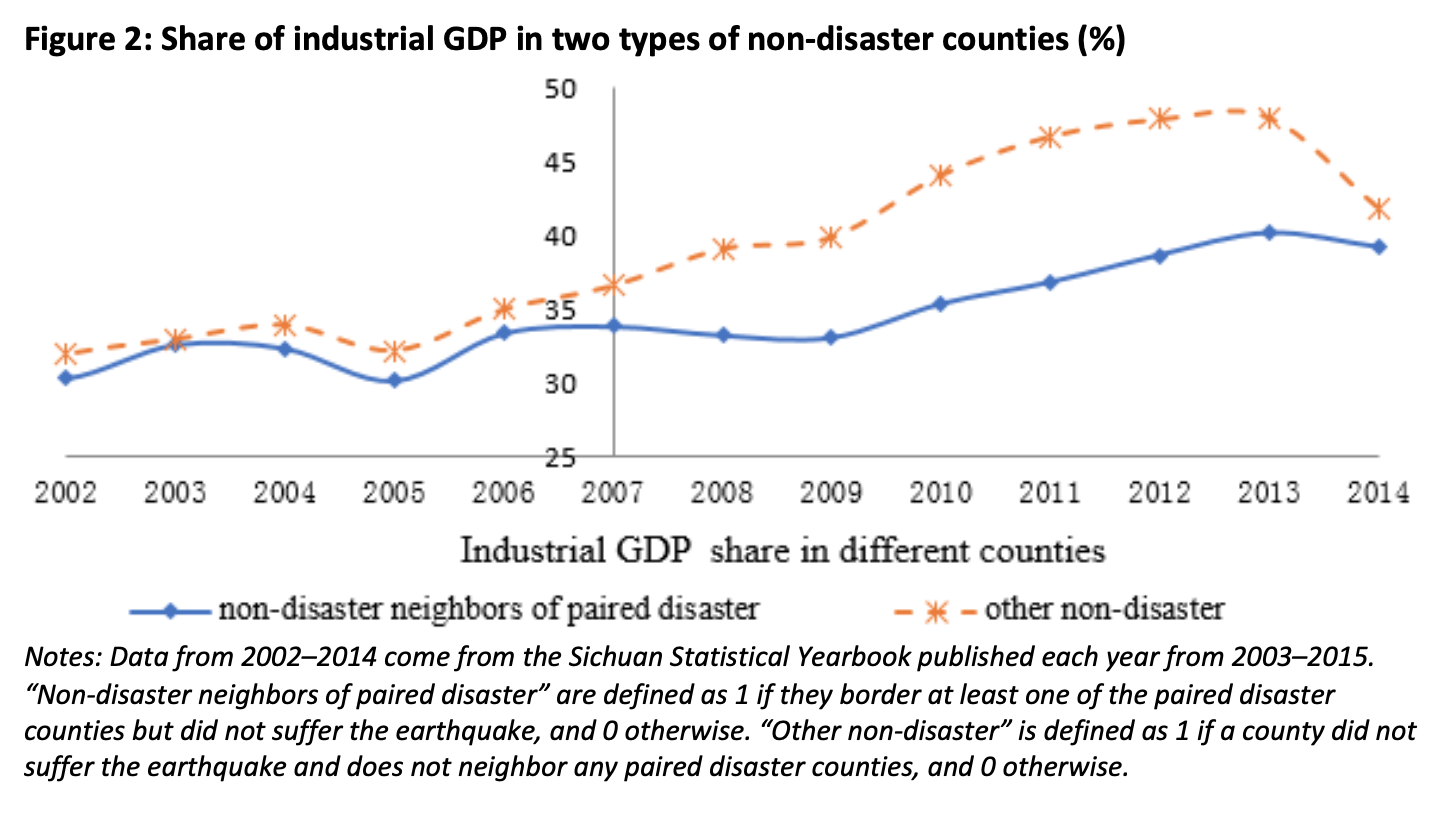

The earthquake not only affected people’s consumption and savings behavior, but also affected sectoral growth at the local level. The earthquake areas received massive aid for relief and reconstruction. The inflow of aid bid up the prices of local services and local wages. Consequently, the manufacturing sector lost competitiveness, as its product prices and wages must be in line with the national market. After the earthquake, there was noticeable shrinking in the share of industrial production in the earthquake areas. However, factories and infrastructure might have collapsed in the earthquake counties, directly affecting industrial production. To isolate the impact of rising local services and wages on industrial production, the article first examines the neighboring counties of earthquake counties, which did not suffer the earthquake. As shown in Figure 2 below, these counties also suffered in industrial production compared to other non-disaster counties. There is still a likelihood that the production network of the neighboring counties suffered from the disruption in the earthquake counties, inhibiting industrial production in the neighboring counties. To rule out this possibility, the paper further investigates investment flows between paired earthquake counties and their neighboring counties and found there is no apparent pattern from 2001 to 2015.

Source: Bulte, Xu, and Zhang (2018)

The finding supports the Dutch disease hypothesis. Rising prices of non-tradables as a result of massive inflows of transfers, mainly pairwise aid, attracted workers to the local service sector from the manufacturing sector, which could not easily adjust output prices. Consequently, the profitability of the manufacturing sector suffered a contraction in the short run.

Ultimately, as pointed out in a book by Chen et al. (2016) that draws lessons from the 2008 earthquake in China’s Sichuan province, a combination of coping and rebuilding strategies, such as widely distributed responses, leveraging external resources, and coordinating effectively with actors on multiple levels and across sectors can enhance resilience against natural disasters, thus limiting the extent of economic fallout. When combined with a better understanding of the emotional response, consumption, and savings behavior of those likely to be affected, these lessons may assist not only China, but other countries as well, in enhancing resilience to natural disasters.

Kevin Chen is IFPRI’s China Program Leader and a Senior Research Fellow with the institute’s Development Strategy and Governance Division (DSGD). Mateusz Filipski is an Assistant Professor of Agriculture and Applied Sciences at the University of Georgia and a former IFPRI Research Fellow. Xiaobo Zhang is a DSGD Senior Research Fellow and Professor of Economics in the National School of Development at Peking University. This post first appeared on VoxChina.