Republished with permission from VoxDev.

Digital cash transfers can be delivered even in active conflict settings like Sudan and can significantly protect vulnerable households—especially in the most insecure areas—from worsening food insecurity, though their impacts vary by context and household characteristics.

While the recent surge in armed conflicts and natural disasters continues to increase demand for humanitarian services, humanitarian organizations face an increasing funding gap to meet this demand. In 2025, only one-third of global humanitarian funding requirements were secured, leaving a funding gap of roughly two-thirds of total needs (UN 2025). In addition to increasing humanitarian needs, armed conflicts complicate the targeting and delivery of humanitarian services (Ghorpade 2017, Lind et al. 20221). Delivering aid in fragile and conflict-affected settings is also prone to aid diversion and misappropriation (Shimada 2025).

Because of these constraints, humanitarian organizations are grappling with the double burden of widening funding gaps and increasing challenges to delivering humanitarian aid to vulnerable households in areas under the control of hostile state and non-state actors. These challenges demand innovative technological solutions that can address compounding constraints, including those arising from inaccessibility due to active conflict.

Armed conflict in Sudan

Sudan’s political situation has remained volatile for decades, but the war that erupted in April 2023 has produced the world’s largest humanitarian crisis (Ahmed et al. 2025). The outbreak of the war between the Sudanese Armed Forces (SAF) and the Rapid Support Forces (RSF) has ravaged the livelihood of millions and displaced millions of people. By the end of 2025, more than 7.8 million people were internally displaced, and another 4.4 million had fled to neighboring countries (UNHCR 2026). With competing global and regional crises, the humanitarian response has fallen considerably short of addressing the magnitude of the crisis.

With nearly 30.4 million people still in dire need of humanitarian assistance, humanitarian efforts have only reached about 13 million people with at least one form of assistance (Humanitarian Action 2025). Beyond the funding gap, military confrontations continue to impede access to humanitarian services.

The case for digital transfers

The advent of digital technologies and transfers, and their potential to address the above challenges associated with delivering humanitarian services, is emerging as an active area of inquiry (Idris 20242, Callen et al. 2025). There are several plausible reasons driving this optimism and inquiry.

First, in fragile and conflict-affected settings, traditional delivery methods can be infeasible, both logistically and financially. Second, beyond facilitating access, digital transfers can significantly reduce the delivery costs of humanitarian services (Callen et al. 2025). For example, Callen et al. (2025) demonstrate that digital transfers can lower delivery costs to under 7 cents per dollar, significantly smaller than the delivery cost for cash-based transfers. A recent multi-country report shows that the median proportion of cash transferred to recipient households is 59% of the total cost of the intervention (Dioptra Consortium 20253). Third, while the use of digital transfers in active conflict remains new, several studies from stable settings show that digital transfers can improve financial inclusion and empower women (Kipchumba and Sulaiman 20214, Riley 2024), ensure transparency and security (Suri et al. 2023, Idris 2024), and reduce social pressure (Riley 2024). Finally, digital delivery of humanitarian assistance can streamline coordination, reduce delays, and enhance transparency for donors (Idris 2024, Callen et al. 2025).

However, digital transfers are unlikely to be a panacea for all humanitarian service-delivery challenges. Digital transfers require some basic infrastructure and level of technological literacy among the population, implying varying access to these services may trigger an inequity in access to humanitarian services. For example, digital payment systems in Sudan continued to face multifaceted divides, including a strong gender divide in both the ownership and use of the internet and mobile phones (FSD Africa 20225). Identifying when and where digital transfers can deliver humanitarian services can inform the scale-up of such technologies in humanitarian programming.

Evaluating the potential of digital cash transfers in active conflict settings

In recent research (Abay et al. 2025), we evaluate the potential and impact of digital cash transfers to support urban households grappling with active conflict in Sudan, where conflict and funding gaps continue to hamper the delivery of essential humanitarian services. We ask whether digital cash transfers can reach those affected by armed conflict and improve food and nutrition security outcomes of beneficiaries in conflict-affected settings. Similarly, we examine whether such transfers can improve subjective well-being and mental health, as well as whether these impacts vary by the size of transfers or socioeconomic characteristics of households.

We address these research questions using a randomized controlled trial (RCT) involving one-time digital cash transfers of different sizes to randomly selected urban residents in Sudan. We introduce two variants of transfer: one that delivers an amount equivalent to the World Food Programme’s (maximum) monthly ration for a family of five ($50) and another with a slightly larger transfer amount ($75). We measure food security using Food Consumption Score (FCS), dietary diversity (DDS), and Food Insecurity Experience Scale (FIES). Similarly, we elicited mental health using Cohen’s Perceived Stress Scale (PSS) and Generalized Anxiety Disorder (GAD) score.

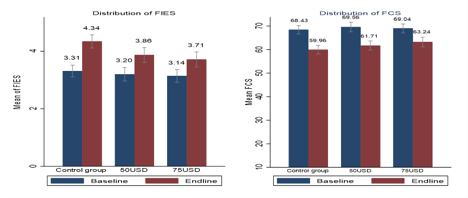

Figure 1 shows that at baseline, both control and treatment groups had comparable levels of food security. However, parallel with the evolution of the armed conflict, conditions worsened after the baseline survey, triggering deterioration in food security across all groups. Recipients of digital transfers, particularly the $75 recipients, were significantly protected and hence witnessed smaller reductions in FCS and less severe experiences of food insecurity. These results suggest that the digital cash transfers shielded households from steep deterioration in food insecurity outcomes.

Figure 1

Food security outcomes at baseline and endline

Who benefits more from digital transfers?

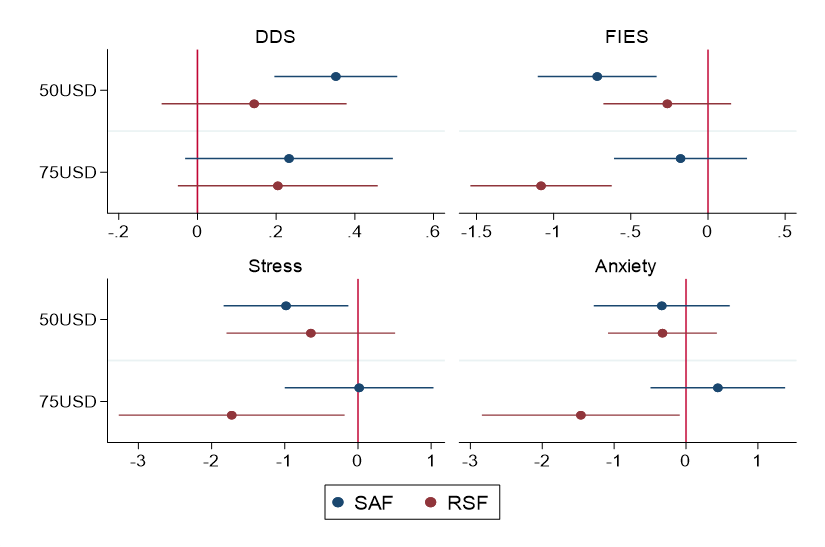

The impact of the digital cash transfer is higher among beneficiaries living in states controlled by RSF (Figure 2). The greater impact observed in RSF-controlled areas could stem from a combination of structural and contextual factors such as liquidity constraints related to the currency changes in SAF-controlled areas, increased violence incidents, and clashes. In general, RSF-controlled states had a lower baseline of food security and mental health outcomes. Thus, the same intervention generates larger marginal improvements among households living in RSF-controlled states, compared to SAF-controlled areas.

Figure 2

The impact of digital transfers is higher among states controlled by RSF

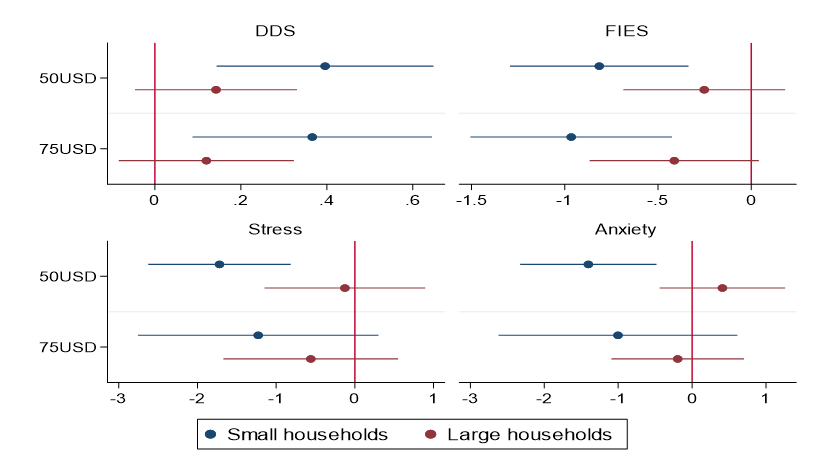

Similarly, the impact of the digital cash transfers is larger for beneficiaries with a relatively smaller household size (Figure 3). The relatively lower impact of digital cash transfers on larger households can be attributed to several factors. First, when a fixed transfer amount is distributed across larger household members, the per capita value of the transfer diminishes. This may weaken the effectiveness of the transfer. Additionally, intra-household allocation of resources can be more complex in larger households, potentially leading to less efficient use of the funds. This pattern aligns with findings from prior research, which show that the effectiveness of cash transfers tends to be lower for larger households unless the transfer size is adjusted proportionally (Ongudi et al. 2024).

Figure 3

The impact of digital transfer is lower for relatively large households

Implications for improving the efficiency of humanitarian services

Amid mounting pressure to improve cost-efficiency in humanitarian service delivery (Bruder and Baar 2024), our findings reinforce that digital transfers can serve as important humanitarian instruments to support populations living through active conflict. This corroborates emerging research about the potential of digital transfers to reach and support an otherwise inaccessible and vulnerable population (Callen et al. 2025).

Our results on the impacts of the digital transfers highlight potential varying returns to digital transfers across various groups, suggesting that the optimal digital transfer may vary across households and contexts (Kondylis and Loeser 20216), depending on their underlying socioeconomic conditions and constraints. Furthermore, our findings suggest potential gains to targeting, including those targeting approaches considering multidimensional criteria beyond deprivation (Haushofer et al. 2025).

Kibrom Abay is a Senior Research Fellow with IFPRI’s Development Strategies and Governance (DSG) Unit based in Washington, D.C.; Lina Abdelfattah is a PhD Candidate in Economics at the University of Bordeaux, France; Hala Abushama is a DSG Research Analyst based in Cairo; Oliver Kiptoo Kirui is a DSG Research Fellow and Acting Program Leader for Nigeria, based in Abuja, Nigeria; Halefom Yigzaw Nigus is a DSG Research Collaborator; Khalid Siddig is a DSG Senior Research Fellow and Leader of IFPRI’s Sudan Strategy Support Program, based in Nairobi, Kenya. This post first appeared on VoxDev. It is based on research that is not yet peer-reviewed. Opinions are the authors’.

This work was supported by the CGIAR Science Program on Food Frontiers and Security.

Reference:

Abay, Kibrom A.; Abdelfattah, Lina; Abushama, Hala; Kirui, Oliver K.; Nigus, Halefom Yigzaw; and Siddig, Khalid. 2025. Can digital cash transfers serve those in active conflict? Evidence from a randomized intervention in Sudan. IFPRI Discussion Paper 2374. Washington, DC: International Food Policy Research Institute. https://hdl.handle.net/10568/177655

- Lind, J, R Sabates-Wheeler, and C Szyp (2022), “Cash and livelihoods in contexts of conflict and fragility: Implications for social assistance programming,” Unpublished manuscript. ↩︎

- Idris, I (2024), “Humanitarian digital transfers in challenging contexts,” Unpublished manuscript. ↩︎

- Dioptra Consortium (2025), “Stretching aid funds: Maximizing the value of multipurpose cash assistance – Cost synthesis of unconditional cash for basic needs,” Unpublished manuscript. ↩︎

- Kipchumba, E, and M Sulaiman (2021), “Digital finance and intra-household decision-making: Evidence from mobile money use in Kenya,” Unpublished manuscript. ↩︎

- FSD Africa (2022), “Supporting digital payments in cash programming: Sudan,” Unpublished manuscript. ↩︎

- Kondylis, F, and J Loeser (2021), “Intervention size and persistence,” Unpublished manuscript.

Lind, J, R Sabates-Wheeler, and C Szyp (2022), “Cash and livelihoods in contexts of conflict and fragility: Implications for social assistance programming,” Unpublished manuscript. ↩︎